EricaHUO

New member

- 2

- 0

Introduction

In the vast realm of financial markets, Forex trading stands out as a dynamic arena where fortunes are made and lost in the blink of an eye. Success in Forex requires more than luck; it demands a well-thought-out strategy. Enter the Forex Trading System, a personalized framework that could be the key to unlocking your trading potential.

Understanding the Forex Trading System

At its core, a Forex Trading System is a set of rules and parameters that guide a trader's decisions. It serves as a roadmap, helping navigate the complex landscape of currency markets. Crafting an effective system involves a careful blend of technical analysis, risk management, and a deep understanding of market psychology.

Components of a Successful Forex Trading System

Once your trading system is meticulously crafted, the next challenge is implementation. Here's a step-by-step guide:

Crafting a Forex Trading System is an art that combines technical prowess with a strategic mindset. While there is no one-size-fits-all approach, a well-designed system can provide a structured framework for success. Remember, the key lies not only in creating the system but in consistently adhering to its rules. With discipline, continuous learning, and a dash of adaptability, you may find yourself navigating the Forex markets with newfound confidence and success.

In the vast realm of financial markets, Forex trading stands out as a dynamic arena where fortunes are made and lost in the blink of an eye. Success in Forex requires more than luck; it demands a well-thought-out strategy. Enter the Forex Trading System, a personalized framework that could be the key to unlocking your trading potential.

Understanding the Forex Trading System

At its core, a Forex Trading System is a set of rules and parameters that guide a trader's decisions. It serves as a roadmap, helping navigate the complex landscape of currency markets. Crafting an effective system involves a careful blend of technical analysis, risk management, and a deep understanding of market psychology.

Components of a Successful Forex Trading System

- Clear Objectives and Goals: Before diving into the market, define your trading goals and risk tolerance. Establish realistic profit targets and acknowledge potential losses. This clarity will act as a compass, preventing emotional decision-making.

- Risk Management Strategies: Mitigating risk is paramount in Forex trading. Determine the percentage of your capital at risk per trade and set stop-loss orders accordingly. A well-designed system should protect your capital during periods of market volatility.

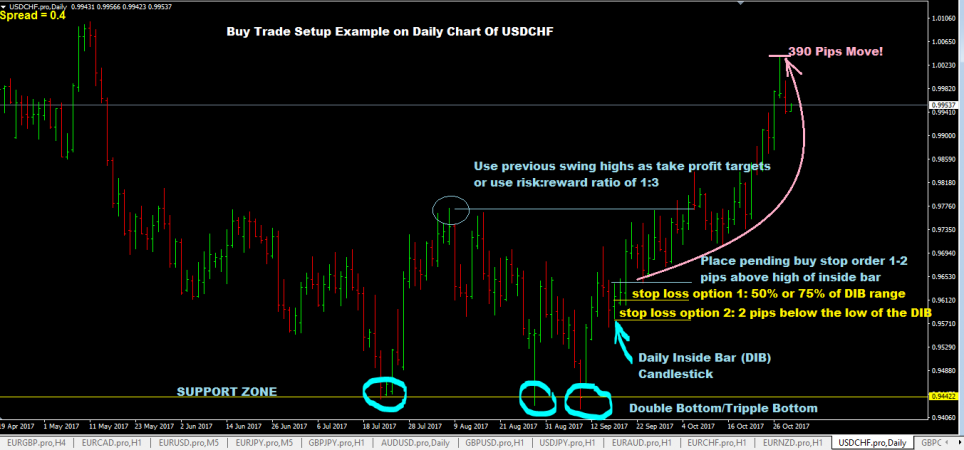

- Technical Analysis Tools: Technical analysis forms the backbone of many trading systems. Utilize tools like moving averages, trendlines, and oscillators to identify potential entry and exit points. Chart patterns and candlestick analysis can further enhance your decision-making process.

- Fundamental Analysis: Complement technical analysis with an understanding of economic indicators, geopolitical events, and central bank policies. A comprehensive approach that considers both technical and fundamental factors can provide a more comprehensive view of the market.

- Backtesting and Optimization: Test your trading system using historical data to ensure its viability. Analyze past performance, identify strengths and weaknesses, and refine your strategy accordingly. Regular optimization ensures adaptability to changing market conditions.

- Discipline and Emotional Control: Emotions often lead to impulsive decisions. A successful trading system instills discipline and helps manage emotions. Stick to your predetermined rules, whether faced with a winning streak or a series of losses.

- Continuous Learning: Forex markets are dynamic, and staying abreast of changes is crucial. Incorporate a learning component into your system, allowing for adaptation to new market trends, technologies, and strategies.

Once your trading system is meticulously crafted, the next challenge is implementation. Here's a step-by-step guide:

- Education: Before executing trades, thoroughly understand the rationale behind your system's rules. This knowledge will instill confidence in your decision-making process.

- Start Small: Implement your system with a small trading capital. This minimizes potential losses during the initial phases and allows you to fine-tune your strategy without significant financial consequences.

- Evaluate and Adjust: Regularly assess your system's performance. If necessary, make adjustments based on changing market dynamics or improvements identified through ongoing analysis.

- Maintain Discipline: Emotional control is challenging, especially during periods of market turbulence. Stick to your system's rules, and resist the temptation to deviate based on fear or greed.

- Continuous Improvement: Forex trading is a continuous learning process. Stay informed about market developments, assess your performance, and adapt your system accordingly. A successful trader is an evolving trader.

Crafting a Forex Trading System is an art that combines technical prowess with a strategic mindset. While there is no one-size-fits-all approach, a well-designed system can provide a structured framework for success. Remember, the key lies not only in creating the system but in consistently adhering to its rules. With discipline, continuous learning, and a dash of adaptability, you may find yourself navigating the Forex markets with newfound confidence and success.